iswd.online

Community

Deposit Money Into Bank Account With Credit Card

To pay at an ATM using checks or cash, insert your credit card into the ATM, then select Make a Payment and follow the instructions (please note that payments. Sometimes you can even deposit money directly into your bank account from your card by submitting a request online. Can you withdraw money from a credit card? There are several ways of transferring cash from your credit card's line of credit over to your bank account. The most common way this is done is called a cash. Fees will apply when using your credit card at any ATM to perform a cash advance or when using a credit card to withdraw cash. See the Deposit Account Rules &. Overdraft fee. Overdrawing your bank account is an easy accident. To help avoid it, sign up for direct deposit so that money is consistently and. on a bank account debit card as a form of surety deposit. Cons of Using money to a savings account, a feature that's impossible with credit cards. Add Cash in Store. Add cash to your Checking account at any CVS®, Walgreens® or Duane Reade by Walgreens® location. A wire transfer is an electronic transfer of money. These bank transfers can usually be done online or you have the option to go to a branch and request the. Some credit card companies send customers checks in the mail. These “convenience checks,” as they are known, are linked to your account. If you deposit them. To pay at an ATM using checks or cash, insert your credit card into the ATM, then select Make a Payment and follow the instructions (please note that payments. Sometimes you can even deposit money directly into your bank account from your card by submitting a request online. Can you withdraw money from a credit card? There are several ways of transferring cash from your credit card's line of credit over to your bank account. The most common way this is done is called a cash. Fees will apply when using your credit card at any ATM to perform a cash advance or when using a credit card to withdraw cash. See the Deposit Account Rules &. Overdraft fee. Overdrawing your bank account is an easy accident. To help avoid it, sign up for direct deposit so that money is consistently and. on a bank account debit card as a form of surety deposit. Cons of Using money to a savings account, a feature that's impossible with credit cards. Add Cash in Store. Add cash to your Checking account at any CVS®, Walgreens® or Duane Reade by Walgreens® location. A wire transfer is an electronic transfer of money. These bank transfers can usually be done online or you have the option to go to a branch and request the. Some credit card companies send customers checks in the mail. These “convenience checks,” as they are known, are linked to your account. If you deposit them.

You add money via paychecks, cash gifts, transfers, or direct deposit. You take money out using checks, electronic transfers, at an ATM, or using a debit card. How do I add my Simplii Financial credit card as a bill payment in Simplii Online and Mobile Banking? Deposit checks with mobile deposit · Add cards to your digital wallet · Send and receive money with Zelle · Get help with Fargo® virtual assistant · View your. Log into your bank's website or connect via the bank's app. · Click on the transfer feature and choose transfer to another bank. · Enter the routing and account. Transfer Using an External Card. Move money to your Navy Federal checking or savings account using an external Visa® or Mastercard® with a few simple clicks. You can use your Spend account for electronic payments and make everyday transactions with your Credit Karma Visa® Debit Card You can also deposit money from. Pick your payment option. Choose whether to pay with your credit3/debit card or with your bank account. 2 convenient ways to deposit cash. Out and about and need to deposit cash to your account? Whether you have your card handy or not, you can add cash at your. How to close a credit card account. Visit a local financial center to How do I deposit money into my personal checking account? You can use a Bank. You can transfer money to a local bank account, a bank account in the United States or to an eligible debit card. Typically, yes, an ATM or debit card permits you to move funds into someone else's account as long as their bank account is linked to yours. It's important to. Discuss your financial needs on a day and at a time that work best for you. Open an account. Explore credit cards, savings or checking accounts, home loans and. Transfer in 1 to 3 business days to a bank account · On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button the more button, then tap. ACH transfer: This is done by transferring money from one account to another. · Cash: If your credit card issuer has in-person bank branches, you can pay your. Add money to your PayPal account by going to your Wallet, clicking Transfer Money, selecting your bank, and entering the amount. It takes up to 5 business. Add cash to your eligible checking account at any CVS®, Walgreens® or Duane Reade by Walgreens® location in the U.S. This money will typically be available. goals: credit cards, auto loans, and home mortgages. 6. You can transfer money to family and friends with ease. Person-to-person payments and mobile app. It's easy to transfer money between your U.S. Bank accounts and accounts at other banks with U.S. Bank mobile and online banking. You can safely control. A credit card lets you borrow money from the bank to spend on your everyday purchases. You can pay your credit card bill using CIBC Online or Mobile. Getting cash, paying bills and depositing checks is simple with a U.S. bank account for Canadians We'll suggest the best bank account and credit card based on.

Benefits Of 403b Plan

A (b) plan is a supplemental retirement plan for certain employees of public schools, tax-exempt organizations and ministers. Individual (b) accounts are. Alliance Benefits is passionate about the Alliance (b) Retirement Plan and the unique and great advantages it provides. Both (b) plans and (k) plans allow you to contribute money, pre-tax, from your paycheck. That money then grows, tax-deferred, until you withdraw the funds. Contributions to the Wisconsin Retirement System (WRS), Wisconsin Deferred Compensation (WDC) or other deferred compensation plans, and Individual. A (b) plan is a voluntary retirement plan with tax advantages that are similar to a (k) plan, but (b) plans are available only to employees of public. Benefits for employers · Funded in part from dollars paid as salary and employer contributions, up to certain statutory limits. · Helps attract and retain quality. Funds held in a (b) plan grow on a tax-deferred basis. Any earnings on plan investments are not taxable as long as they remain in the plan. Only when an. The George Washington University Supplemental Retirement Plan ((b) Plan) allows you to make Pre-Tax or Post-Tax Roth contributions. Advantages of (b) Plans Earnings and returns on amounts in a regular (b) plan are tax-deferred until they are withdrawn. Earnings and returns on amounts. A (b) plan is a supplemental retirement plan for certain employees of public schools, tax-exempt organizations and ministers. Individual (b) accounts are. Alliance Benefits is passionate about the Alliance (b) Retirement Plan and the unique and great advantages it provides. Both (b) plans and (k) plans allow you to contribute money, pre-tax, from your paycheck. That money then grows, tax-deferred, until you withdraw the funds. Contributions to the Wisconsin Retirement System (WRS), Wisconsin Deferred Compensation (WDC) or other deferred compensation plans, and Individual. A (b) plan is a voluntary retirement plan with tax advantages that are similar to a (k) plan, but (b) plans are available only to employees of public. Benefits for employers · Funded in part from dollars paid as salary and employer contributions, up to certain statutory limits. · Helps attract and retain quality. Funds held in a (b) plan grow on a tax-deferred basis. Any earnings on plan investments are not taxable as long as they remain in the plan. Only when an. The George Washington University Supplemental Retirement Plan ((b) Plan) allows you to make Pre-Tax or Post-Tax Roth contributions. Advantages of (b) Plans Earnings and returns on amounts in a regular (b) plan are tax-deferred until they are withdrawn. Earnings and returns on amounts.

Advantages of a (b) Plan for employees · Employees may choose to make contributions pretax or Roth which are made after-tax. · They pay no income taxes on. The (b) retirement plan provides eligible faculty and staff with the opportunity to accumulate tax-deferred retirement funds. Our (b) plan has been nationally recognized as a low cost, soundly managed retirement savings option for Wisconsin public school employees. Like all retirement plans, (b) plans offer tax advantages—enabling you to save on taxes now and in some cases later, if your plan offers a Roth option. Save. Participating in the (b) Plan can help supplement retirement planning, and will not reduce any other University benefits. See the (b) Universal. A (b) plan allows you to set aside money for your future retirement security, via payroll deduction while you are still working. Employees may participate in the Supplemental Retirement (b) Plan which establishes individual annuity and/or custodial accounts. The (b) Plan and (b) Plan are supplemental retirement plans that allow you to save up to the IRS limits for additional savings. In , you can save up to $23, in any combination of pretax or Roth contributions to the (b) Plan, plus another $23, in pretax or Roth contributions. System Human Resource Services» Benefits» Retirement & Investment Plans» University (b) Plan» Enroll In, Change, or Stop Your (b) Contributions. A (b) is a retirement plan available for employees in health care, education, and other tax-exempt organizations. · (b)s offer tax advantages, though the. Benefits · Medical, Dental, & Vision Benefits · Reimbursement Accounts · Employee Discounts · Retirement · Retirement Plans at a Glance · Employees' Retirement Plan. The (b) plan features most closely resemble a (k) plan. Key differences among the options include when you can access your funds without a penalty and tax. The plan was established to provide retirement benefits and savings opportunities to employees and to provide benefits to their beneficiaries in the event of. (b) contributions can be deducted from your paycheck, giving you a steady path to retirement savings. A (b) Retirement Savings Plan allows you to save and invest money for retirement with tax benefits. The value of the account depends on the amount of. Future benefits from the (b) Plan will reflect the amount of a participant's vested account balance plus earnings. Plan Summary · Eligibility · UofL. An advantage is that your contributions and earnings may be eligible to be tax-free at retirement. Roth contributions are combined with pre-tax contributions. Emory's (b) Savings Plan is a tax-deferred retirement plan which Benefits then (b) Certification). Employer contributions will start as. Because (b) and (b) plans are governed by different sections of IRS Code, employees may contribute to both plans concurrently, allowing a combined.

How Much Is A Good Amount To Invest

When someone asks how much money they should save each month, I throw them a curveball reply: "What are your savings goals"? · At least 20% of your income should. Proper risk management has more to do with the position size of one's investment than the total investment capital. The amount of risk in an investing strategy. Invest about 20% of my gross income which goes to pension contribution, k, s, and personal brokerage account. Step 1: Savings Goal. Savings Goal. Desired final savings. ; Step 2: Initial Investment. Initial Investment. Amount of money you have readily available to invest. As an investment in the debt of one company (Ford Credit), the Notes do not meet the diversification or investment quality standards for money market funds set. The typical American making $40, a year needs at least $k invested with a % annual return to live off interest alone. Estimate how much you need. You don't need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $1, thanks to zero-fee brokerages. Here's the question you face: Should you invest it all right away or in smaller increments over time, a strategy known as dollar-cost averaging? As you gain more experience and confidence in the stock market, you can consider investing more. Remember to research and choose investments. When someone asks how much money they should save each month, I throw them a curveball reply: "What are your savings goals"? · At least 20% of your income should. Proper risk management has more to do with the position size of one's investment than the total investment capital. The amount of risk in an investing strategy. Invest about 20% of my gross income which goes to pension contribution, k, s, and personal brokerage account. Step 1: Savings Goal. Savings Goal. Desired final savings. ; Step 2: Initial Investment. Initial Investment. Amount of money you have readily available to invest. As an investment in the debt of one company (Ford Credit), the Notes do not meet the diversification or investment quality standards for money market funds set. The typical American making $40, a year needs at least $k invested with a % annual return to live off interest alone. Estimate how much you need. You don't need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $1, thanks to zero-fee brokerages. Here's the question you face: Should you invest it all right away or in smaller increments over time, a strategy known as dollar-cost averaging? As you gain more experience and confidence in the stock market, you can consider investing more. Remember to research and choose investments.

It's a question that requires a fair amount of introspection and analysis. AMOUNT INVESTED, AND ARE: · NOT FDIC INSURED · NOT BANK GUARANTEED · NOT A. Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. Pick the right tools. There are many savings and investment accounts suitable for short- and long-term goals. And you don't have to pick just one. Look. So if you're making $50,, that's the amount of money you should have saved by However, you may be paying off student loans or trying to save for a new. Most financial planners advise saving 10% to 15% of annual income. A savings goal of $ a month amounts to 12% of your income. About how much money do you currently have in investments? This should be the total of all your investment accounts, including (k)s, IRAs, mutual funds. That sum could become your investing principal. Your principal, or starting balance, is your jumping-off point for the purposes of investing. Most brokerage. “I am saving 30% of my income every month” is a SMARTer goal than “I want to save money and become rich.” So, start with a budget and determine what portion of. Utilize low-cost index funds with low expense ratios. Similarly, choose no-load mutual funds. Using a free robo-advisor can also be a good strategy. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at How much is my house worth? Real estate resources · Buying a home 12 min read Total amount you will initially invest or have currently have invested toward. You won't be able to access this money until you are 55, but these benefits make pensions ideal for investing longer term. However, if you're not enrolled in a. In the pursuit of any financial goal, it's smart to stop and consider whether to save or invest the money you set aside for it. It used to be true that you. Through the investment strategy known as “dollar cost averaging,” you can protect yourself from the risk of investing all of your money at the wrong time by. price of a quantity of gold. End amount – The desired amount at the end of the life of the investment. TIPS offers an effective way to handle the risk of. Good news! You don't need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $1. The general rule is 30% of your income, but many financial gurus argue that 30% is much too high. money saved in liquid investments, and good-quality. It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs.

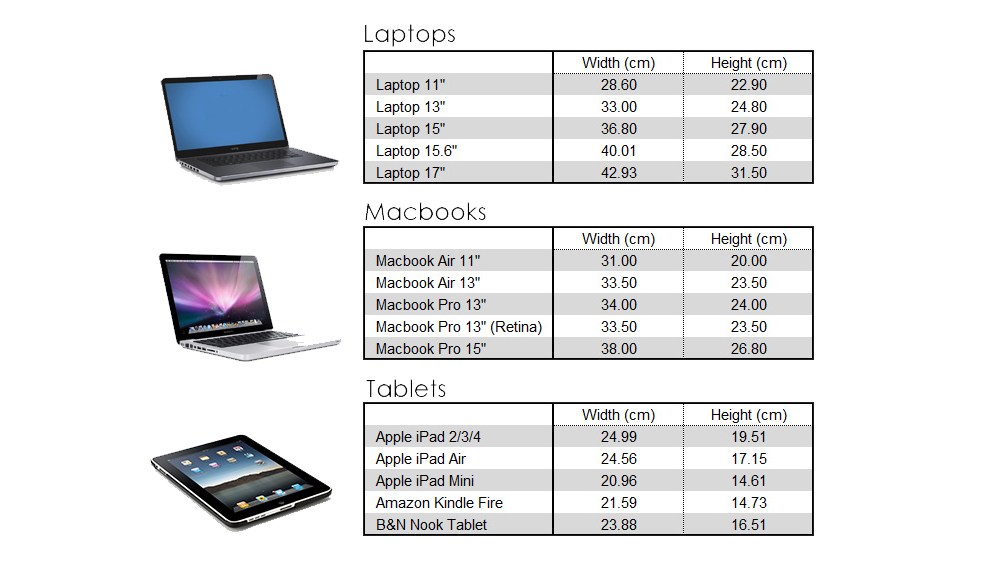

What Is The Size Of A Laptop

A laptop computer or notebook computer, also known as a laptop or notebook, is a small, portable personal computer (PC). Laptops typically have a clamshell. Usually shown diagonally from corner to corner, laptop screen sizes are Though they are among the smaller models, inch laptops offer an. To measure the screen size of your laptop, take a tape measure or ruler and measure the diagonal distance from one corner of the screen to the opposite corner. Then measure straight across your laptop and square that number. Add these two numbers together, then use a calculator to find the square root of that sum. This. Looking for the perfect laptop bag? Our Size Guide measures which Eastpak bags fit common laptop and tablet sizes. Find your new trusty companion today! The file size is too big. A video can be up to 1 GB. We encountered a problem My HP 17" laptop fits fine with extra room in the bag for laptops. In terms of usage situation, inch laptops fit between the inch and inch models. This provides more space, but it's not too big to take with you every. Stay up-to-date with the latest Laptop-M features: viewport, screen size, CSS pixel ratio, CSS media query, and cross-browser compatibility, all essential. The inch size of your laptop refers to the screen's diagonal measurement from edge to edge. This size doesn't include the casing that surrounds the screen. A laptop computer or notebook computer, also known as a laptop or notebook, is a small, portable personal computer (PC). Laptops typically have a clamshell. Usually shown diagonally from corner to corner, laptop screen sizes are Though they are among the smaller models, inch laptops offer an. To measure the screen size of your laptop, take a tape measure or ruler and measure the diagonal distance from one corner of the screen to the opposite corner. Then measure straight across your laptop and square that number. Add these two numbers together, then use a calculator to find the square root of that sum. This. Looking for the perfect laptop bag? Our Size Guide measures which Eastpak bags fit common laptop and tablet sizes. Find your new trusty companion today! The file size is too big. A video can be up to 1 GB. We encountered a problem My HP 17" laptop fits fine with extra room in the bag for laptops. In terms of usage situation, inch laptops fit between the inch and inch models. This provides more space, but it's not too big to take with you every. Stay up-to-date with the latest Laptop-M features: viewport, screen size, CSS pixel ratio, CSS media query, and cross-browser compatibility, all essential. The inch size of your laptop refers to the screen's diagonal measurement from edge to edge. This size doesn't include the casing that surrounds the screen.

The screens for laptops, phones and tablets come in different sizes. And while the screen still has a certain measurement for width and height. Laptops Size Chart ; cm, 11 inch ; cm, 12 inch ; cm, 13 inch ; cm, 14 inch ; cm, 15 inch. Size. One of the key points of a laptop is portability. Smaller laptops are lightweight and easier to carry. A bigger laptop offers a bigger screen size. acer Aspire 3 " FHD IPS Screen Laptop | AMD 4-Core Ryzen 5 U | Radeon Vega 8 Graphics | 12GB RAM DDR4 | GB NVMe SSD | Full-Size Keyboard with NumPad. The average is about inches for your normal day-to-day laptops. Ultrabooks and gaming laptops are averaged right around 17 inches. Netbooks. The average is about inches for your normal day-to-day laptops. Ultrabooks and gaming laptops are averaged right around 17 inches. Netbooks. A larger screen size of 18”, will provide a beautiful, large display for enhanced immersion — similar to a desktop monitor. Screen size. Laptop screen sizes range from about 11 up to 17 inches, measured diagonally. A larger screen is ideal for gaming, watching movies, photo and. Your laptop's screen size is calculated by taking the width of the screen and multiplying it by height to get its dimensions in inches. This results in awkward hand and wrist postures. • Monitor size - Laptop screens are often smaller, resulting in increased eye strain. • Monitor placement - The. Looking for the perfect laptop bag? Our Size Guide measures which Eastpak bags fit common laptop and tablet sizes. Find your new trusty companion today! Panel Skin Size, " x 3" (cm x cm), " x " (cm x cm). Laptops come in various sizes to serve different demands of customers. The most popular options are 10, 11, 12, 13, 14, 15, and 16 inches. Tiny or mighty? Choosing the best laptop screen size! We compare portability & screen real estate to help you find the perfect fit for work & play. Usually shown diagonally from corner to corner, laptop screen sizes are Though they are among the smaller models, inch laptops offer an. Laptops come in various sizes to serve different demands of customers. The most popular options are 10, 11, 12, 13, 14, 15, and 16 inches. This guide will help you comprehend the vital aspects of laptop screen size and the nuances of Windows display settings. The global laptop market is bifurcated into up to ", 11" to ", 13" to ", " to ", and more than 17”. The " to " segment owns the. This comprehensive guide dives into the essentials of how to measure laptop size, laying down a clear, step-by-step process to ascertain the precise. SCREEN SIZE. 14 inch 15 inch 16 inch 17 inch. PROCESSOR. INTEL AMD. GRAPHICS Up to W TGP with NVIDIA® GeForce RTX™ Laptop GPU (8 GB GDDR6 dedicated).

10 Best Credit Cards

Browse U.S. News picks for the best cash back credit cards. We help you compare cash back credit cards to select the one that can earn the most with your. The best card for non-category spending right now is probably the Alliant CU Visa Signature with % cash back on everything. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. Is American Express (NYSE:AXP) the Best Credit Card Stock? TipRanks. Tue, Sep 10, , AM CDT 4 min read. In this article: AXP. American Express. Find the best credit cards of this September for rewards, cash-back, 0% APR and more. Choose from our top options for every budget and situation. best use your points from our team of credit card experts. Credit cards compared. Illustration of 2 credit cards side by side. 10 MIN READ. Capital One. + Show Summary · Capital One SavorOne Cash Rewards Credit Card · Chase Sapphire Preferred® Card · Wells Fargo Reflect® Card · Citi® Diamond Preferred®. Capital One QuicksilverOne Cash Rewards Credit Card ; N/A* · %-5% (cash back) · % (Variable) · $ Best Rewards Credit Cards of September · Chase Freedom Unlimited® · Chase Sapphire Preferred® Card · Best in Airline and Rewards Credit Cards · Best in. Browse U.S. News picks for the best cash back credit cards. We help you compare cash back credit cards to select the one that can earn the most with your. The best card for non-category spending right now is probably the Alliant CU Visa Signature with % cash back on everything. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. Is American Express (NYSE:AXP) the Best Credit Card Stock? TipRanks. Tue, Sep 10, , AM CDT 4 min read. In this article: AXP. American Express. Find the best credit cards of this September for rewards, cash-back, 0% APR and more. Choose from our top options for every budget and situation. best use your points from our team of credit card experts. Credit cards compared. Illustration of 2 credit cards side by side. 10 MIN READ. Capital One. + Show Summary · Capital One SavorOne Cash Rewards Credit Card · Chase Sapphire Preferred® Card · Wells Fargo Reflect® Card · Citi® Diamond Preferred®. Capital One QuicksilverOne Cash Rewards Credit Card ; N/A* · %-5% (cash back) · % (Variable) · $ Best Rewards Credit Cards of September · Chase Freedom Unlimited® · Chase Sapphire Preferred® Card · Best in Airline and Rewards Credit Cards · Best in.

Explore all of Chases credit card offers for personal use and business. Find the best rewards cards, travel cards, and more. Apply today and start earning. cardsBest airline credit cardsBest college student credit cardsBest credit cards for groceries Featured Video. Video preview image. Video: Credit. Capital One Venture Rewards Credit Card: Best for non-bonus spending · Chase Sapphire Preferred® Card: Best for beginner travelers · Capital One Venture X Rewards. Best Credit Cards of September · Chase Freedom Unlimited® · Chase Freedom Unlimited® · Chase Sapphire Preferred® Card · Best in Cash Back and No Annual Fee. Browse the best credit cards of for cash back, travel rewards, 0% APR, credit building and more. Find the best one for you and apply in seconds. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. with your Meijer Credit Card and save an additional 10¢1 off per gallon on top of your mPerks fuel discount at the pump. 5. lift nozzle and do a happy dance. Credit level: Excellent Good Fair Rebuilding ; Card type: Student Secured Business Personal ; Rewards: Cash Back Travel Dining $0 Annual Fee. Credit diversity involves 10 percent of a FICO score, and every digit counts when applying for the lowest possible interest rates and loan products with. Credit cards for good scores ; Capital One Quicksilver Cash Rewards Credit Card · reviews · % - 5% ; Chase Sapphire Preferred® Card · reviews · 1x - 5x. Citi Credit Cards · Chase Credit Cards · American Express Credit Cards · Capital One Credit Cards · Discover Credit Cards · Bank Of America Credit Cards · Wells Fargo. Chase Sapphire Preferred® Card – this is the best overall card for folks who want to travel the world via credit card rewards. Credit card for bad credit. Discover it® Secured Credit. We're going to cover 10 of the best business credit cards available for LLCs, and what your LLC needs to consider to choose the right credit card for your. I have 10 credit cards, which means I have 10 different bills to pay each month. Here's how I manage them, and how I choose the best card to use to make the. I currently have Amex Gold and Prime Visa with a Savor One (10% ubereats and free uber one), and I think I have most categories covered. What I. Chase Sapphire Preferred® Card – this is the best overall card for folks who want to travel the world via credit card rewards. Learn more about Discover credit cards and apply for the best credit card 10, then the standard purchase APR applies. Standard purchase APR: x. Best no-annual-fee credit cards · Chase Freedom Flex℠: With no annual fee, you won't have to pay for bonus cash back. · Chase Freedom Unlimited®: For a card with. There are many types of travel cards, and they often come with sign-up bonuses and robust rewards programs.

Good Option Trading Stocks

IV Rank: Options Volume: The total options volume traded today across all options for the underlying Stock or ETF. % Put: The percentage of the total options. There are 4 categories of options traders active in the exchanges - Retail investors, Institutional traders, broker-dealers and market makers. Learn about options trading, how it works and five basic option strategies. For the best user experience, please use an updated browser. Similar to trading stocks, use fundamental indicators to help you to identify options. trading in stock index futures and options. Trading is conducted electronically as well as through auction bidding by securities companies. The TSE is. Stock options vs. shares — and trading options vs. stocks — are different terms and experiences. When it comes to which is a better choice, this is an. Best stock for trading options: [1] Futu Holdings [2] Netflix [3] Upstart [4] Moderna [5] Mohawk Industries [6] Apple [7] Nvidia. The options chain gives you a quick overview of the market for options on the underlying stock. You can see trading volume, price changes, and shaded areas that. Top 8 Stocks for Options Trading in India · Hindustan Unilever · State Bank of India · Infosys · HDFC Bank · ICICI Bank · Adani Green · Adani Ports · Reliance. IV Rank: Options Volume: The total options volume traded today across all options for the underlying Stock or ETF. % Put: The percentage of the total options. There are 4 categories of options traders active in the exchanges - Retail investors, Institutional traders, broker-dealers and market makers. Learn about options trading, how it works and five basic option strategies. For the best user experience, please use an updated browser. Similar to trading stocks, use fundamental indicators to help you to identify options. trading in stock index futures and options. Trading is conducted electronically as well as through auction bidding by securities companies. The TSE is. Stock options vs. shares — and trading options vs. stocks — are different terms and experiences. When it comes to which is a better choice, this is an. Best stock for trading options: [1] Futu Holdings [2] Netflix [3] Upstart [4] Moderna [5] Mohawk Industries [6] Apple [7] Nvidia. The options chain gives you a quick overview of the market for options on the underlying stock. You can see trading volume, price changes, and shaded areas that. Top 8 Stocks for Options Trading in India · Hindustan Unilever · State Bank of India · Infosys · HDFC Bank · ICICI Bank · Adani Green · Adani Ports · Reliance.

Unlike stocks, options allow you to gain exposure to a stock, whether it's on the rise, fall, or even moving sideways. Like a Swiss Army knife, options give you. Options strategies are not get-rich-quick schemes and can also have unlimited loss potential. Transactions generally require less capital than equivalent stock. unlimited $0 online option trades, with no trade or balance minimums as well More Investment Choices. Invest your way with access to a wide range of stocks. A calendar spread is an income trade that involves selling a short-term option and buying a longer-term option with the same strike price. Cameco mining stocks. My recommendation would be to follow stocks or indexes like SPY and use calendar spreads or diagonals to generate income. They all won't. It stands to reason that selling options with a high option premium will generate the most income. · As of this writing, the list of stocks with the highest. Both futures and stock options offer traders the ability to use increased leverage. This means that, as a trader, you can control a larger position with less. Is Options Trading Better Than Stocks? Options trading can be riskier than trading stocks. However, when it is done properly, it can be more profitable for. market makers to provide investors with the best possible price. Both trading and open outcry interaction to meet all of your options trading needs. There are stocks are listed for options trading in NSE. This includes options of some of the biggest stocks in India like: Reliance Industries · Tata. Most Active Stock Options ; MSFT, Microsoft Corporation, , ; PLTR, Palantir Technologies Inc. , ; COIN, Coinbase Global, Inc. What Are the Best Stocks for Options Trading? · $AMD: Advanced Micro Devices · $AAPL: Apple · $GOOG: Google · $NFLX: Netflix · $FB: Facebook · $ROKU: Roku · $. stocks, indexes and ETFs which have the most traded options volume during the current market session. The table conveniently groups stock, ETF and index options. Options provide opportunities to trade securities at specific prices and can help monetize a stock position. You need to understand the risks before investing. U.S. investors can trade options on a wide range of financial products—from individual stocks or stock exchange-traded funds (ETFs) to indexes, foreign. Personally, I look for stocks that are relatively cheap: let's say trading between about $ and $ per share. Why is this? Well, when selling puts, I. Open Trading Account ; FEDERALBNK, Sep, ; GAIL, Sep, ; ICICIBANK, Sep, 1, ; TATAPOWER, Aug, r/options: Let's Talk About: Exchange Traded Financial Options -- Options Fundamentals -- The Greeks -- Strategies -- Current Plays and Ideas -- Q&A. Open Trading Account ; FEDERALBNK, Sep, ; GAIL, Sep, ; ICICIBANK, Sep, 1, ; TATAPOWER, Aug, Medium_(website)_logo. How John Foley, CEO of Options AI, is Empowering Options Traders to Convert Great Ideas Into Smarter Trades · mondo-vision-logo. RiskFuel.

How To Promote Website

How I promote my website? · Keyword Research: Identify and use relevant keywords like "ASVAB practice test." · Quality Content: Create informative, engaging. But by allowing powerful websites or blogs link to your platform, you will be creating quality backlinks that convince search engines that your site is. 1. Focus on Website SEO · 2. Make sure your website is optimized for search. · 3. Take advantage of local SEO. · 4. Use Google Posts to promote. Watch: Design a Website to Promote a Project - a video lesson from Applied Digital Skills that is free of charge. How I promote my website? · Keyword Research: Identify and use relevant keywords like "ASVAB practice test." · Quality Content: Create informative, engaging. One of the very easy ways to start promoting websites on Facebook is by informing your Fb fans about blog updates. That's can be easily done with useful fb apps. In this article, I'll discuss 12 ways to promote your website for free. So read on and start promoting your website today! Create a website visitors ad · Go to your Facebook Page. · Click Promote. You can find it at the top of your page. · Select Create new ad. · Select Get more website. In this article, I'll discuss 11 proven strategies and tactics to show you how to promote your website like a pro. How I promote my website? · Keyword Research: Identify and use relevant keywords like "ASVAB practice test." · Quality Content: Create informative, engaging. But by allowing powerful websites or blogs link to your platform, you will be creating quality backlinks that convince search engines that your site is. 1. Focus on Website SEO · 2. Make sure your website is optimized for search. · 3. Take advantage of local SEO. · 4. Use Google Posts to promote. Watch: Design a Website to Promote a Project - a video lesson from Applied Digital Skills that is free of charge. How I promote my website? · Keyword Research: Identify and use relevant keywords like "ASVAB practice test." · Quality Content: Create informative, engaging. One of the very easy ways to start promoting websites on Facebook is by informing your Fb fans about blog updates. That's can be easily done with useful fb apps. In this article, I'll discuss 12 ways to promote your website for free. So read on and start promoting your website today! Create a website visitors ad · Go to your Facebook Page. · Click Promote. You can find it at the top of your page. · Select Create new ad. · Select Get more website. In this article, I'll discuss 11 proven strategies and tactics to show you how to promote your website like a pro.

Build Your Website Go-To Market Strategy · Find Traditional and Non-Traditional PR · Create Promotional Content · Determine Your Unique Marketing Mix · Measure Your. Use Facebook, Instagram, and LinkedIn to promote blog posts and other useful pages on your website. boost website traffic. Social media advertising. Once your website's online, you'll want to make sure it's easy to find via search engines such as Google. Patience is key here. A brand new store won't. Either way, blogging is a tool for establishing your expertise in a specific area, driving more traffic to your website via SEO and engaging with your audience. You can promote it by making good and interesting content and do some backlinks SEO also it will help your site to boost up in google search engine. To get started, use strategies like guest blogging or submitting your site's URLs to directories. Begin by searching for publications that accept guest bloggers. 2. Create targeted landing pages · 4. Use digital ads to promote your site · 5. Boost your local search reputation · 7. Get more backlinks from trusted sources · 8. This article will show you how to promote your website for free effortlessly, including blogging, email marketing, and social media. Facebook can be an effective way to promote your website. Using the social networking website, you can explore free promotional campaigns or pay for. The following 10 strategies are all designed to promote your website before other strategies like search engine optimization (SEO) take effect. Read on to learn awesome tips that will help you promote your website to the max in and increase your organic website traffic. There are several marketing strategies available to help you promote and market your new website, some are free, and some aren't. Facebook can be an effective way to promote your website. Using the social networking website, you can explore free promotional campaigns or pay for. Every time you publish an optimized post, it adds content to your website, which means search engines have another opportunity to share your site with the right. Search engine optimization (SEO) is the key strategy that will get your website ranked well in search results. However, there are other things you can do as. Getting your website to the top of the search engines can be costly and time consuming if you get a professional SEO company to do this for you, however, there. Boost any post to turn it into an ad. Just decide where to send users, who should see it and how much to spend. See How. Build multi-platform campaigns with. Once your store is set up, you can start promoting your site to your existing customer base. We'll also talk about how to make your website easy to find for new. We've put together some tips on how you can benefit from other tools and resources if you don't think the expense, time, and effort of a website is for you.

Charitable Contribution Tax Deduction

Under the Internal Revenue Code, the deduction for charitable contributions is limited to a maximum of 20%, 30%, or 50% of a taxpayer's adjusted gross income. Depending on the type of charitable credit, there are limitations on the total amount that can be allocated, the types of taxes the credit can be used to offset. You can take the charity donation tax deduction for your non-cash single charitable donation for one item or a group of similar items is more than $5, if the. To be deductible for income tax purposes, a charitable contribution must meet the following requirements: there must be a transfer of property by the donor. Under the Internal Revenue Code, the deduction for charitable contributions is limited to a maximum of 20%, 30%, or 50% of a taxpayer's adjusted gross income. The limit on the deductibility of cash charitable contributions to an eligible (c)(3) organization as an itemized deduction on your tax return is 60% of. By using the proper tax planning strategies, charitable contributions can reduce three kinds of federal taxes: income, capital gains and estate taxes. Your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (AGI), but in some cases 20%, 30%, or 50% limits may. Charitable Deductions Generally · 30 percent of the taxpayer's contribution base, or · the excess of 50 percent of the taxpayer's contribution base for the tax. Under the Internal Revenue Code, the deduction for charitable contributions is limited to a maximum of 20%, 30%, or 50% of a taxpayer's adjusted gross income. Depending on the type of charitable credit, there are limitations on the total amount that can be allocated, the types of taxes the credit can be used to offset. You can take the charity donation tax deduction for your non-cash single charitable donation for one item or a group of similar items is more than $5, if the. To be deductible for income tax purposes, a charitable contribution must meet the following requirements: there must be a transfer of property by the donor. Under the Internal Revenue Code, the deduction for charitable contributions is limited to a maximum of 20%, 30%, or 50% of a taxpayer's adjusted gross income. The limit on the deductibility of cash charitable contributions to an eligible (c)(3) organization as an itemized deduction on your tax return is 60% of. By using the proper tax planning strategies, charitable contributions can reduce three kinds of federal taxes: income, capital gains and estate taxes. Your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (AGI), but in some cases 20%, 30%, or 50% limits may. Charitable Deductions Generally · 30 percent of the taxpayer's contribution base, or · the excess of 50 percent of the taxpayer's contribution base for the tax.

You can deduct your contributions only if you make them to a qualified organization. How to check whether an organization can receive deductible charitable. The charitable deduction is limited to 50% of the taxpayer's Part B income, whether the charitable gifts are cash or otherwise, including appreciated securities. What is a charitable donation? What is a tax-deductible donation? A tax-deductible donation is a charitable contribution of money or goods to a qualified, tax. If you itemize your deductions, you may be able to deduct charitable contributions of money or property made to qualified organizations. Only donations actually. Charitable contribution deductions for cash contributions to public charities and operating foundations are limited to up to 60% of a taxpayer's adjusted gross. A business that donates inventory can deduct the cost of the inventory as a business expense. If a charitable donation tax receipt is requested by the business. The limit on tax deductions for charitable contributions to qualified charitable organizations is up to 60% of your adjusted gross income (AGI). Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written. A taxpayer who both makes qualifying charitable contributions and claims the standard deduction on their federal income tax return for the same tax year can. What is a charitable donation? What is a tax-deductible donation? A tax-deductible donation is a charitable contribution of money or goods to a qualified, tax. KEY CONCLUSION: The deduction is effective at equalizing the state-level tax benefit provided to taxpayers who make charitable contributions and claim the. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. You can take a tax deduction for charitable donations made to a qualified organization. You may donate between 1% and 2% of your annual income. You can deduct charitable contributions from your taxable income—if you follow IRS rules about documenting your gifts. You'll receive a tax deduction in the year that the contribution is made (see rules for public charities in the chart above). A charitable contribution shall be allowable as a deduction only if verified under regulations prescribed by the Secretary. In general, cash contributions to public charitable organizations may be deducted up to 60% of adjusted gross income, with limits on non-cash contributions and. Your deduction limit will be 60% of your AGI for cash gifts. Note that if you're planning a large donation that's close to or exceeds your AGI limit, you may. The charitable deduction subsidizes charitable giving by lowering the net cost to the donor. If the tax deduction spurs additional giving, charitable.

Do You Pay Taxes On Silver

Texas is one of many states that does not tax the sale of numismatic coins or gold, silver or platinum bullion. That means buyers do not have to pay the tax. For example, if you sold gold and used the proceeds to buy silver, you would not have to pay capital gains taxes on the transaction. This makes In the State of Texas, sales of gold and silver are not subject to sales tax. If shipping an order to your state would cause you to incur sales tax for silver. This act additionally exempts from state income tax the portion of capital gain on the sale or exchange of gold and silver specie that are otherwise included in. When you purchase products on iswd.online, we may have to collect sales tax on some or all of the products you purchase. The amount you pay OR don't pay will. However, if that same gold investor had converted their gold bullion for silver bullion, they would have enjoyed an % increase in wealth over the period. Holdings in precious metals such as gold, silver or platinum are considered to be capital assets, and therefore capital gains may apply. You will pay no sales tax on standard gold and silver bars, nor on coins such as the Maple Leaf, the Gold and Silver Panda, the US Eagle, the Perth Mint. Therefore, in the eyes of the IRS, any profits a customer acquires through the sale of their precious metal assets is considered taxable and is therefore. Texas is one of many states that does not tax the sale of numismatic coins or gold, silver or platinum bullion. That means buyers do not have to pay the tax. For example, if you sold gold and used the proceeds to buy silver, you would not have to pay capital gains taxes on the transaction. This makes In the State of Texas, sales of gold and silver are not subject to sales tax. If shipping an order to your state would cause you to incur sales tax for silver. This act additionally exempts from state income tax the portion of capital gain on the sale or exchange of gold and silver specie that are otherwise included in. When you purchase products on iswd.online, we may have to collect sales tax on some or all of the products you purchase. The amount you pay OR don't pay will. However, if that same gold investor had converted their gold bullion for silver bullion, they would have enjoyed an % increase in wealth over the period. Holdings in precious metals such as gold, silver or platinum are considered to be capital assets, and therefore capital gains may apply. You will pay no sales tax on standard gold and silver bars, nor on coins such as the Maple Leaf, the Gold and Silver Panda, the US Eagle, the Perth Mint. Therefore, in the eyes of the IRS, any profits a customer acquires through the sale of their precious metal assets is considered taxable and is therefore.

For example, if you sold gold and used the proceeds to buy silver, you would not have to pay capital gains taxes on the transaction. This makes When you purchase products on iswd.online, we may have to collect sales tax on some or all of the products you purchase. The amount you pay OR don't pay will. Collectibles sold at a gain are subject to ordinary income tax rates if held for one year or less. You need to know your cost basis to calculate your taxable. Before making an online property tax payment by credit card, customers should ensure that they have their current property tax bill and pay only the appropriate. Gold, silver, and platinum bullion whose price exceeds $ is not taxable. Georgia. Georgia sales taxes apply to specific products listed below: All copper or. Do not use this overview to figure your tax. If your income is under You should report your local income tax amount on line 28 of Form Your. Sales of gold, silver, and platinum bullion are exempt if the sales price This document is intended to alert you to the requirements contained in. Key Findings · Legal tender UK gold coins are capital gains tax-free, though CGT may be liable for sales of gold bars and non-UK gold coins. · Legal tender UK. CGT is chargeable on all gold, silver and platinum coins that are not produced by The Royal Mint as they are not considered to be UK legal tender. Also, all. The state of Florida doesn't tax capital gains, but residents must still pay United States federal capital gains taxes. If you would like to research the. Capital Gains Tax. As previously mentioned, selling precious metal coins, rounds, and bullion can serve as an additional source of income for many clients. Sales in bulk of "monetized bullion", nonmonetized gold or silver bullion, and numismatic coins which sales are substantially equivalent to transactions in. It is a Federal crime total gold sales. Some states charge a tax, but if your state; where the item was shipped from does not have a gold tax law it is a crime. You do pay CGT on some gold and silver bullion. The IRS considers non-legal tender gold bars and coins to be 'collectibles' for income tax purposes. If you hold. Coins comprised of gold and silver are tax exempt. Bullion is tax exempt. Currency is taxable. Kentucky. Coins, Currency & Bullion are taxable. Louisiana. Coins. Federal Capital Gains Tax. As is the case throughout the United States, if you sell your gold or silver for a profit (which is to say that you received more. The tax that you pay when selling gold is the same as your regular income tax rate. Sellers, who take a loss when selling gold, do not need to pay tax. All gold and silver bullion bars are taxable with CGT, so this can be an important consideration for large investors. If you have any concerns/questions. America's leader in precious metals investments where you can invest in gold, silver, platinum or palladium with confidence. Gold, silver, platinum, palladium and coins. The following coins and metals are not included in the definition of “collectible” under IRC Section (m).

Spraying Deodorant On Balls

Ball Buddy Deodorant Dry Powder Spray (Non-Aerosol) helps with moisture control, chafing prevention, and odor protection through a mess-free sprayer. Includes: (1) Fresh Feet 4 oz Anti-Bacterial Odor Fighting Spray, (1) Fresh Balls oz Antiperspirant. Spray in your shoes, on your toes and socks. Shake well before use · Use on dry skin after showering, or spray before any physical activity · Spray liberally on hot zones prone to sweat and chafe. · Don't be. Separate and soften fabrics, while reducing drying time and static cling with the help of our Wool Dryer Balls natural deodorant spray. Final price $17 CAD. Rather than covering up body odors with extra cologne for your pits & balls, Mando blocks odor before it starts. Use It Everywhere. Mando goes beyond just. Sack Spray Refreshing Deodorizer. 2oz, Body oz, Deodorant. Pitstick Activated Charcoal Deodorant. $ Pitstick. Cucumber and witch hazel keeps your balls cool and Derm Dude's proprietary DeoPlex formula destroys odor. Spray after a shower or throughout the day to stay. Anti Chafing, Cooling, Deodorizing, Toning & Soothing Mist is a Touch-Less Spray precisely formulated to suit sensitive skin to ease irritation, itching and. Natural & Organic Ball Wash Lotion+Ball Deodorant Spray+Anti-Chafing Nut Balm Cream to Stay Fresh, Dry & Moisturized All Day. Ball Buddy Deodorant Dry Powder Spray (Non-Aerosol) helps with moisture control, chafing prevention, and odor protection through a mess-free sprayer. Includes: (1) Fresh Feet 4 oz Anti-Bacterial Odor Fighting Spray, (1) Fresh Balls oz Antiperspirant. Spray in your shoes, on your toes and socks. Shake well before use · Use on dry skin after showering, or spray before any physical activity · Spray liberally on hot zones prone to sweat and chafe. · Don't be. Separate and soften fabrics, while reducing drying time and static cling with the help of our Wool Dryer Balls natural deodorant spray. Final price $17 CAD. Rather than covering up body odors with extra cologne for your pits & balls, Mando blocks odor before it starts. Use It Everywhere. Mando goes beyond just. Sack Spray Refreshing Deodorizer. 2oz, Body oz, Deodorant. Pitstick Activated Charcoal Deodorant. $ Pitstick. Cucumber and witch hazel keeps your balls cool and Derm Dude's proprietary DeoPlex formula destroys odor. Spray after a shower or throughout the day to stay. Anti Chafing, Cooling, Deodorizing, Toning & Soothing Mist is a Touch-Less Spray precisely formulated to suit sensitive skin to ease irritation, itching and. Natural & Organic Ball Wash Lotion+Ball Deodorant Spray+Anti-Chafing Nut Balm Cream to Stay Fresh, Dry & Moisturized All Day.

Looking for ball deodorant spray for men? Shop Differio for Ballsy Sack Spray for groin & body, chafing & jock itch relief. Buy top manscaping products. Ball Deodorant Manscaped(5) · Dove Men +Care Whole Body Deo Spray Men's Deodorant, Shea Butter & Cedar oz · Happy Nuts The Refresher Men's Natural Aluminum. Moisturizing ball deodorant that keeps your skin smelling fresh and feeling hydrated. Infused with aloe and tapioca starch. Play it cool. This ball spray features cooling witch hazel and aloe to keep your intimate areas smelling great and feeling refreshed. iswd.online: All Natural Ball Spray Deodorant for Men. Groin Deodorant Spray with Organic Tea Tree Oil. All Natural Crotch Itch Spray. The anti chafing spray specifically made to be applied on your pubic area will keep your balls fresh, dry, comfortable, and friction-free throughout the day. Antiperspirant Deodorant with Balls purchase ✓ product ✓ Between them, for example: Deodorants Dove Antiperspirant Aerosol Advanced Care Talco ml. WHEN LIFE THROWS CURVE-BALLS, INSTANTLY FRESHEN YOURS! This on-the-go, odor absorbing, refreshing sack spray is an absolute must to banish smelly balls. MENHOOD The Baller (Bubble Gum), Balls Spray For Men Private Parts, Intimate Body Mist Deodorant Spray - For Men (50 ml) ; KILLER. WAVE All-Day Long Lasting. Hold can upright and spray from 6 inches away on your armpits or chest for a fragrant pick-me-up. Spray on as much (or as little) as you want. Use it in the. Feel fresh down there with our Ball Deodorant. Lasts 2 months with standard usage. Vegan, Not Tested on animals. iswd.online: All Natural Ball Spray Deodorant for Men. Groin Deodorant Spray with Organic Tea Tree Oil. All Natural Crotch Itch Spray. Deodorant Your Balls(36) Happy Nuts The Refresher Men's Natural Aluminum Free Ball Deodorant Spray, Original, 2 oz. Happy Nuts The Refresher Men's Natural. OMGWTFBBQ. Dude that's just wrong. Bear in mind they ain't gonna wanna lick yer balls if they taste like deodorant! Permalink · tracerfirefm. Keep your Balls smelling Fresh with our collection of Ball Sprays, Ball Amaze Balls Refreshing Deodorizing Ball Spray. scroll down! more products below. Discover a new level of comfort with our Natural Ball Deodorant. Specifically designed for men, it tackles the main issue of groin and crotch rashes, offering. Ball Buddy Deodorant Dry Powder Spray (Non-Aerosol) helps with moisture balls fresh, dry, and odor-free all day. UMPIRE~ MALE DEODORANT SPRAY M.D.S. FOR FOUL BALLS GAG GIFT! PHEW is a trademark of Iron Root Systems Inc.. Filed in December 27 (), the ~UMPIRE~ MALE. Ball Sack Deodorant · Relieves Itching · Prevents unpleasant odor · Offers instant comfort · Combat sweat and moisture · Specially designed for male personal care. Spray powder onto your nuts after cleansing, trimming, or shaving. Comfort Powder can be used on the groin and feet areas, as well as any other area that.

1 2 3 4 5